Is There An Economic Crisis Looming? Business Tax Refunds Hit Record Low for 2023

When people hear the words “business tax refund,” they automatically assume that more refunds are good and fewer refunds are bad; i.e., the economic situation must not be the best if business tax refunds are dropping in size and scale.

That isn’t necessarily the case, as multiple factors besides the economy, such as state laws and policies and federal legislation, influence the business tax refund environment.

Lower business tax refunds don’t mean we are on the precipice of an economic disaster; in many cases, they mean businesses are managing their operations better.

However, the tax system and its relationship to economics are a mosaic of moving and complicated parts, and it’s essential to understand the relationship between tax, economy, business, and government policy.

Key takeaways

- Contrary to popular belief, lower business tax refunds in 2023 may reflect improved tax planning and financial stability rather than economic distress.

- State-specific tax policies and incentives significantly influence the amount of business tax refunds rather than each state’s economy.

- Business tax refunds can offer insights into economic health and effective tax management, but government policy also plays a key role.

- Business tax refunds are a mosaic created by state policy, the economy, and occasionally federal policy; everything should be weighted together to determine the real significance.

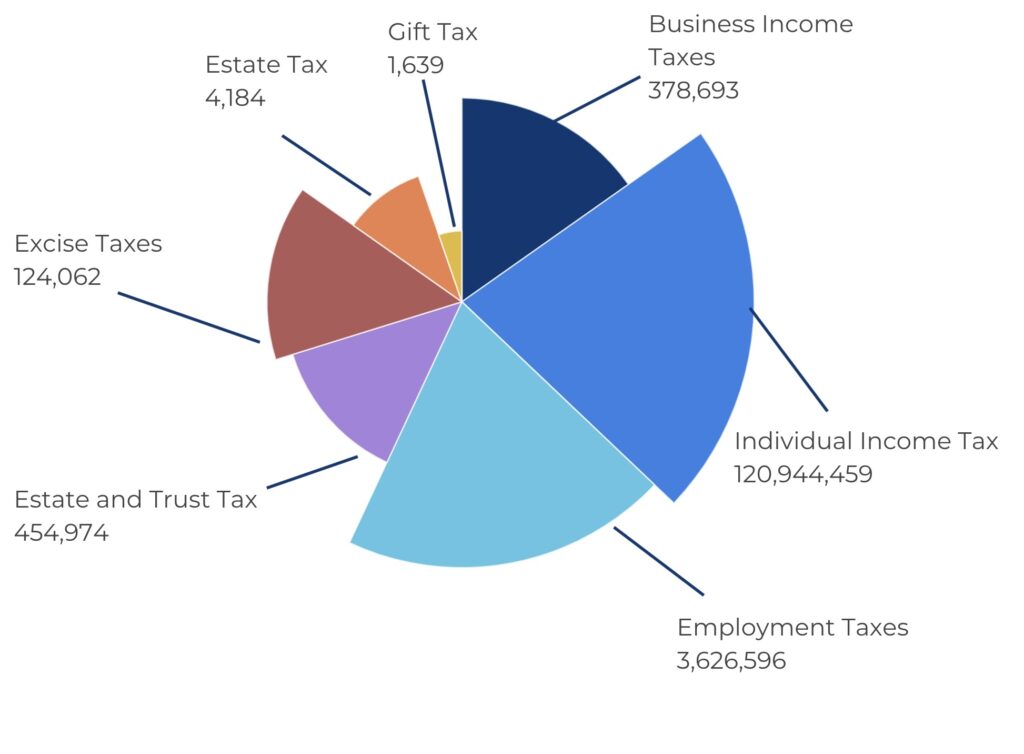

How many business tax refunds were processed in 2023?

In 2023, the IRS processed 378,693 business income tax refunds. A business tax refund occurs when a business overpays its estimated taxes throughout the year and realizes that it has paid more than its actual tax liability after filing its tax return.

The IRS then refunds this excess payment. This data reflects the overall economic activities and tax liabilities of businesses across the United States, offering a glimpse into the financial health of the business sector for the year.

Breakdown of business tax refunds by state

The business tax refunds processed by the IRS in 2023 varied significantly across different states. Below is a map with a breakdown per state

Which states have the most business tax refunds and why?

| State | Amount |

|---|---|

| California | 56,195 |

| Texas | 37,723 |

| Florida | 33,477 |

| New York | 29,631 |

| Illinois | 13,725 |

The main driver of business tax refunds, on an aggregate scale, is tied to the size of the population and the amount of business activity in a state. States like California, Texas, and New York drive the American economy and showcase everything from Silicon Valley to Wall Street.

Business tax refunds also tend to be higher in states with favorable tax policies and incentives that attract more businesses. For example, California offers the California Competes Tax Credit, which provides tax credits to companies that invest and create jobs in the state.

In the Southwest, Texas provides various incentives, such as the Texas Enterprise Fund and the Research and Development Tax Credit, which help reduce businesses’ tax burden.

It should also be pointed out that the legal structure of businesses in these states, such as LLCs and S-corporations, allows for more advantageous tax treatments, increasing the likelihood of refunds

Which states have the lowest amount of business tax refunds and why?

| State | Amount |

|---|---|

| Alabama | 3,097 |

| Nevada | 4,105 |

| Indiana | 4,558 |

| Oregon | 4,813 |

The main contributor to lower business tax refunds in certain states is often linked to less favorable tax environments and fewer business incentives.

States like Alabama, Nevada, Indiana, and Oregon typically have fewer large-scale businesses than states with higher refunds, resulting in lower overall business activity and, consequently, lower tax refunds. Economic policies, business environment, and state-specific tax regulations also play significant roles.

For example, Alabama and Indiana have limited tax credits and deductions available for businesses, leading to a higher overall tax burden and smaller refunds. Alabama’s tax system includes a business privilege tax and high sales taxes, which increase business costs and reduce potential refunds.

Although Nevada doesn’t levy a corporate income tax, it imposes a gross receipts tax that burdens businesses with high revenues but low-profit margins and limits tax refunds.

Oregon’s corporate activity tax on gross receipts impacts businesses with significant revenues but narrow profit margins, resulting in higher tax liabilities and lower refunds.

What does a decrease in business tax refunds mean for the economy?

It isn’t very easy, to say the least. In many cases, a decrease in business tax refunds can be a good sign for the economy. A decrease in business tax refunds generally indicates that businesses are paying closer to their actual tax liabilities, which can occur due to improved tax planning, higher profits, or fewer eligible deductions and credits.

Lower tax refunds mean businesses retain less excess cash but also suggest they are more financially stable and more efficient in their tax management and planning.

That being said, on a state level, things differ and are more tied to government policies and regulations in that state vs. overall economic health. The larger states will always have higher refund numbers because of their size and population.

However, a smaller state might have high business tax refunds due to its tax policies and incentives, which differ from state to state, as seen above.

Employment tax refunds vs business tax refunds in gauging economic health and direction

Employment and business tax refunds reflect economic health in different ways. Lower employment tax refunds indicate precise payroll tax calculations and stable employment costs, reflecting steady employment levels and business operational consistency.

High employment tax refunds suggest either overestimated payroll expenses or fluctuating employment trends.

Conversely, lower business tax refunds are related to corporate income taxes and can provide insights into business profitability and tax planning accuracy.

When businesses receive lower refunds, it often indicates stronger financial performance and effective tax management, suggesting a healthy economic environment. Both types of refunds serve as important indicators, highlighting trends in business activity, employment, and overall financial stability.

How other tax refunds implicate the state or direction of the economy?

Tax refunds, such as the child tax credit (CTC) and the earned income tax credit (EITC), play a big role in the economy by helping families spend more and reduce poverty.

Child tax credit

The CTC gives financial help to families with kids, which means they have more money to spend on things they need. For example, when families get advance payments from the CTC every month, they can spend more throughout the year, which helps local businesses and boosts the economy.

Earned income tax credit

The EITC is another important credit that helps working families with low to moderate incomes by lowering the amount of taxes they owe and sometimes giving them a refund. This extra money encourages people to work and helps lift families out of poverty, giving them more money to spend.

Some states have their own EITC programs, which strengthen these benefits and lead to more spending and economic stability in those areas.

Do low business tax refund numbers mean we are on the brink of an economic crisis?

Why it could mean there are problems

Low business tax refund numbers indicate economic distress, where businesses struggle with lower profits and reduced investment. This could signify broader economic issues, such as a recession or a downturn in key industries, reducing business activity and tax payments.

If businesses are unable to generate sufficient revenue, it can result in lower overall economic growth and increased financial instability within the state.

Why it might not mean there are any problems

However, low business tax refund numbers do not necessarily signal an impending economic crisis. They could also reflect efficient tax planning and accurate tax payments by businesses, indicating financial stability and effective management.

In these cases, companies might pay the exact amount they owe without overestimating their tax liabilities, leading to lower refunds and a stable economic environment.

How does federal policy influence business tax refunds?

Some of the most important economic legislation and policies enacted on a federal level over the last twenty years have contained specific clauses related to business tax refunds. Many of these policies were created in response to severe economic shocks, such as the 2008 Global Financial Crisis and the 2020 CARES Act, which was passed during the beginning of the COVID-19 pandemic.

In this case, business tax refunds increased because the economy was in crisis. Thus, on a Federal level, legislation tied to an increase in business tax refunds can be seen as a tool for economic recovery, meaning the economy is/was not doing well.

| Legislation | Year | Effect on Business Tax Refunds |

|---|---|---|

| Economic Stimulus Act | 2008 | Provided tax rebates to stimulate the economy, including accelerated depreciation and other business tax incentives. |

| Tax Cuts and Jobs Act | 2017 | This major tax reform reduced corporate tax rates, introduced the full expensing of certain capital investments, and altered deductions. |

| CARES Act | 2020 | Provided extensive tax relief and business tax refunds, including net operating loss (NOL) carrybacks and the Employee Retention Credit. |

| Consolidated Appropriations Act | 2021 | Extended various tax provisions from the CARES Act, including enhancements to the Employee Retention Credit and other business tax credits. |

Bottom line: Business tax refunds are influenced by both the economy & government policy

A decrease in business tax refunds on a macro level doesn’t mean the economy is doing poorly; it most likely means that businesses are dotting their is and crossing their ts better and don’t need various refund incentives.

However, government policy is an important key driver at both the state and federal levels, in many ways more of an important indicator than economic health. The bottom line is that although business tax refunds indicate where the economy is, on a state level, government policy is more important.

Methodology

To determine the influence of state laws, federal policies, and tax planning on business tax refunds, we analyzed the following aspects:

- State-Specific Tax Policies: We examined how different states’ tax policies and incentives impact the number of business tax refunds.

- Federal Legislation: We assessed the effects of significant federal tax policies and economic stimuli on business tax refunds.

- Tax Planning and Financial Health: We evaluated the relationship between tax planning accuracy and business financial stability, as indicated by the size and frequency of refunds.

By integrating these datasets and examining them through state and federal policies, the study will comprehensively understand the factors influencing business tax refunds in 2023.