Corporate Transparency Act 2019: What Businesses Must Know

One of the most important pieces of the National Defense Authorization Act of 2021 is the Corporate Transparency Act. Aiming to enhance corporate transparency by requiring certain businesses to disclose information about their “beneficial owners” or people who own and control the company.

This is important to ensure that LLCs and companies aren’t engaging in illicit activities, such as money laundering or tax evasion. The Corporate Transparency Act is important, but it can be complicated for business owners and legal staff. We will look at the key definitions, reporting requirements, the process of submitting, and the potential penalties for not complying.

What is the Corporate Transparency Act?

Requiring certain companies to report their beneficial owners to the Financial Crimes Enforcement Network, the Corporate Transparency Act was passed to identify the individuals who ultimately own or control these entities, combating serious financial crimes such as money laundering and tax evasion. It was included in the National Defense Authorization Act (NDAA) for 2021.

An important part of this legislation is creating a federal database managed by FinCEN, also known as the Financial Crimes Enforcement Network. The database contains basic information about the beneficial owners of certain companies in the United States, making it accessible to law enforcement, financial institutions, and other authorized parties on a confidential basis.

Without this database and the law instituted by the Corporate Transparency Act, there wouldn’t be an effective mode of enforcement against serious financial crimes, which can include a range from money laundering to human trafficking. By requiring companies to report their owners, there is direct accountability and easier communication between agencies and the company.

Key Definitions in the Corporate Transparency Act

To find out where you fall according to the CTA, here are some key definitions you should remember:

Reporting Company

The CTA defines a reporting company as a business that needs to file information about its owners with the government, including companies formed by filing with a state or foreign businesses registered to do business in the United States.

Beneficial Owner

A beneficial owner meets the two components of ownership and control over an entity.

Company Applicant

Company applicants are different from beneficial owners, either the person who fills out and files the document or the person responsible for the document’s content, even if they do not submit it.

Substantial Control

FinCEN defines substantial control over a company in 4 ways:

- Senior officer positions, such as CEO, CFO, General Counsel, or similar roles

- Appointing power: having the authority to appoint and remove directs or similar roles

- Voting Rights: Controls voting rights in the company that influence major decisions

- Financial Authority: Having the ability to direct significant financial transactions.

This is important because they all focus on the ability to significantly influence the company’s direction, finances, or operations.

Interests Making an Individual a Beneficial Owner

The main two components of establishing a beneficial owner are control and the percentage of ownership interests owned. People who own 25% or more of the ownership interests of the company fulfill the ownership interest requirement, but the control requirement is a little more specific. If those criteria are met, you are considered a beneficial owner.

Reporting Requirements under the Corporate Transparency Act

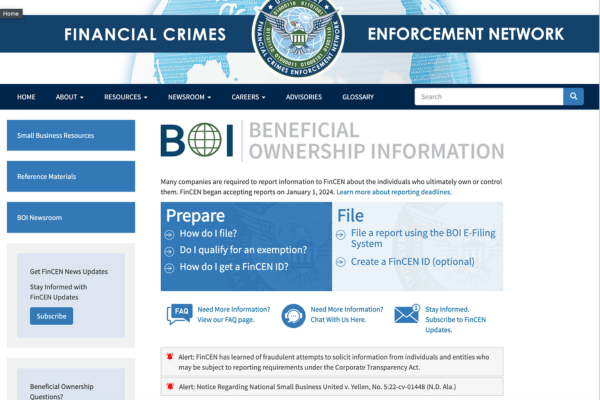

The Financial Crimes Enforcement Network began accepting beneficial ownership reports at the beginning of this year, so it is important to submit accurate information as soon as possible. Here are some of the key requirements under this new transparency act:

Information Reported to FinCEN

There are two main components to the information that you have to disclose to the Corporate Transparency Act:

Company information that you must disclose includes the legal name, the trade name, the address, the jurisdiction of where it was formed, and its federal tax ID.

For the beneficial owners, you need to report your full legal name, date of birth, current address, ID number, and image of your ID documents. ID documents can include passports and driver’s licenses.

Deadline for Reporting

It is important to file within 30 days of the entity’s formation for any company created after January 1st, 2024. Any changes to previously existing information should be updated within 30 days of the established change.

Exemptions From Reporting

A reporting company is any entity created by filing a document with a secretary of state or similar office under the law of a State or Indian Tribe, other than:

- An accredited educational institution, such as a college or high school

- A registered investment company or investment adviser

- A public company

- An inactive company or business solely for holding passive investments

- Certain entities that are obligated to other beneficial ownership reporting requirements, such as banks

- Or tribal businesses.

There is also an exemption for large operating companies, defined as a company with over 20 full-time employees, maintaining a physical presence in the US, and having $5 million in gross receipts from US sales in the previous year.

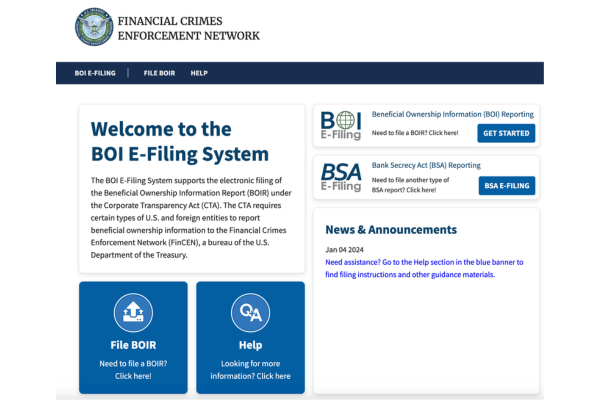

Process for Submitting Reports to FinCEN

You can report beneficial ownership information by electronically filing the report using FinCEN’s BOI reporting system. You can then choose between uploading your report as a PDF or filing using their online form. After filling out the information, you can submit it!

FinCEN’s website includes frequently asked questions to guide you through the process, and there are no fees associated with submitting your BOI report.

Access to Beneficial Ownership Information

While FinCEN does keep information on beneficial owners of reporting companies, there is no way for the general public to access your sensitive data. The only entities with access would be law enforcement agencies and financial institutions required by law to perform due diligence for their customers. These entities also have to pass FinCENs requirements to access the information to ensure that it isn’t used for commercial purposes.

Once your report beneficial ownership information, there is a litany of access controls and data security measures in place to ensure no leakage.

Governmental entities such as the secretary of state would not have direct access to the BOI information found in FinCEN, as there is a primary focus on law enforcement agencies and aren’t intended for general use by governmental agencies. It would be used primarily for investigations.

Compliance with the Corporate Transparency Act

The Corporate Transparency Act requires these reports to be submitted as of January 1st, 2024, but other aspects, such as the Financial Crimes Enforcement Network database, were enacted on January 1st, 2021. After your initial report, you only have to file when the information changes, so you don’t have to worry about submitting an annual report.

If information about your company changes after your initial report is submitted, you have 30 days to file a new report without losing your compliance. Some corrections are available for inaccurate reports that are submitted, and reporting agencies are required to correct their mistake within 30 days of their discovery.

Notifications of exemption after you have filed your previous report, the ongoing reporting requirement should cease automatically. While notification isn’t necessary, you should contact FinCEN directly if you wish to do so. Previously existing companies have a grace period until January 1st, 2025, to file their initial report, but it is best to get it done as soon as possible to ensure that you stay in compliance.

Penalties and Consequences of Non-Compliance

The penalties for breaking this transparency law cover civil and criminal legal grounds, as well as potential risk of harm to your business reputation, lawsuits, and difficulties obtaining licenses in the future. These consequences can be quite severe, so it is best to always act in good faith when reporting to FinCEN.

Civil penalties include financial penalties, generally in the form of a daily fine per day each day that the violation continues. However, for criminal penalties, you can be charged with up to $10,000 in fines and two years in prison. Report beneficial ownership information changes or errors as soon as possible to avoid unnecessary penalties.

3 Steps to Prepare for Corporate Transparency Act Compliance

Some of the things that you can do to begin and maintain your compliance are:

Step 1: Find Your Company Applicants and Your Beneficial Owners

Identifying your beneficial owners and the people who will fill out your report beforehand makes collecting important information much easier. Your company applicant is responsible for filling out and submitting the finished BOI report on the Financial Crimes Enforcement Networks Website, and the Beneficial Owner should ensure they have all of their relevant information ready to prepare.

Step 2: Gathering and Verifying Required Information

Collecting your information before your report is good for identifying potential changes before they happen, making applying for changes much more predictable than in the past. Make sure that you have your required ID numbers and documentation up to date, including relevant addresses and aliases before submitting it to the Financial Crime Enforcement Networks System.

Step 3: Establishing Internal Process for Ongoing Compliance

Establishing an internal process for ongoing compliance is a great way to keep your information current and minimize the risk of civil liability. Keep your company applicant informed of any changes that you have in your information so that you can remain in compliance. A 30-day deadline can be a tight turnaround, so make sure to let them know as soon as possible!

Fulfill Corporate Transparency Act Compliances with TaxCredits

The Corporate Transparency Act provides an important service, and making sure to report correctly can save your business hundreds of dollars a day. Having a certified public accountant by your side is a surefire way to ensure that your information stays up to date and that you stay compliant with important transparency laws. TaxCredits is here to provide you with the services you need to file your initial report and answer any questions you may have about this important process.

FAQs

Who voted for the Corporate Transparency Act?

The Corporate Transparency Act didn’t get voted on by individual representatives but was passed with the National Defense Authorization Act (NDAA) for 2021. The NDAA passed with a vote of 249 to 173 in the House of Representatives.

Who created the Corporate Transparency Act?

There isn’t a single person who is credited with creating the Corporate Transparency Act, there are multiple sponsors from both political parties that assisted in its addition to the National Defense Authorization Act.

Who Sponsored the Corporate Transparency Act?

The sponsors for the Corporate Transparency Act in the legislature include Senators Sherrod Brown, a Democrat from Ohio, Mike Crapo, a Republican from Indiana, Carolyn Maloney, a Democrat from New York, and Patrick McHenry, a Republican from North Carolina.