Manufacturing R&D Tax Credits – Eligibility & More

Did you know the manufacturing industry claims annual R&D tax credits of over $7.4 billion? The Research and Development Tax Credit (R&D Tax Credit) is a federal benefit that provides a dollar-for-dollar reduction in a company’s tax liability for certain domestic expenses.

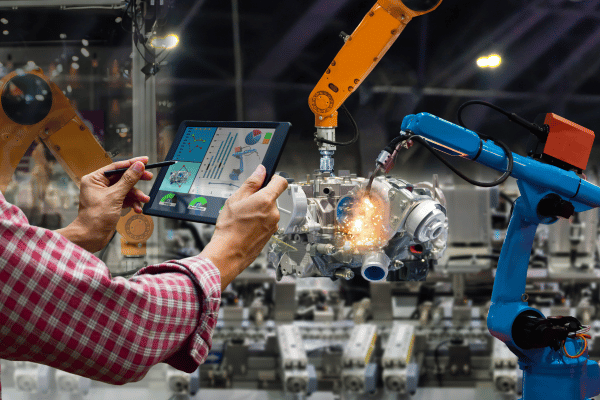

Because manufacturing companies are heavily involved in innovation, many are eligible for a manufacturing R&D tax credit. How can these enterprises qualify for this tax benefit? We’ll discuss this further in this article.

What are Manufacturing R&D Tax Credits?

The R&D tax credit is a federal tax benefit supporting companies working on innovative science and technology projects. Because manufacturing companies are heavily involved in creating innovative solutions, plenty are eligible for this tax benefit.

Who qualifies for Manufacturing R&D Tax Credits?

Contrary to what some might think, research and development go beyond scientists in a laboratory. Many manufacturing processes can qualify under these tax incentives. Companies that are involved in the following may file for the R&D tax credit:

- Engaged in product design or process improvement activities as an original equipment manufacturer (OEM) or contract manufacturer

- Utilize computer-aided design (CAD), computer-aided manufacturing (CAM), or computerized numerical control tools (CNC) to improve or create prototypes, fixtures, and manufacturing processes.

- Product development and design relying on systematic trial and error

- Engineer new or improved products and manufacturing processes to create new revisions to part numbers and systems

- Work with new material specifications or enhance your capabilities by bringing outsourced processes into your facility

Four-Part Test for Qualifying Activities

Manufacturing firms that pass the following four-part test may file for R&D Tax Credit:

Permitted Purposes

The activity must relate to a new or improved business component’s function, performance, reliability, quality, or composition. It should intend to develop a new or improved product, process, or software. Moreover, it ensures that the research is not conducted for non-commercial purposes, such as social science or arts-related endeavors.

Technological in Nature

The activity should rely on biological sciences, physical sciences, computer sciences, scientific methods, or engineering principles to qualify for the credits. This requires using technology or engineering in a science field. Moreover, its goal is to improve or develop a software, product, or process’s performance, functionality, quality, or reliability.

Elimination of Uncertainty

The activities must discover information that may eliminate uncertainty about a particular capability or method for improving or developing a process or product.

Process of Experimentation

The activity must involve experimentation, evaluating alternatives, simulation, and hypothesis confirmation through trial and error, testing, and modeling. It should also involve a systematic process to assess at least one alternative, including modeling, prototyping, testing hypotheses, and iterative analysis. The activity should also identify alternatives and test potential solutions.

Qualifying Research Activities for Manufacturing Firms

Here are activities manufacturing firms can list as qualified research activities under this tax credit:

- Alternative material testing

- Design and development of cost-effective operational processes

- Design and evaluation of process alternatives

- Design of manufacturing equipment

- Development of second-generation or improved products

- Assessment and determination of the most efficient flow of material

- Improve product quality

- Integrate new materials to improve product performance and manufacturing processes.

- Optimization of manufacturing processes

- Product development utilizing computer-aided design tools

- Prototyping and three-dimensional modeling

- Tooling and equipment fixture design and development

Not all processes create tax credit opportunities. For example, maintaining research facilities doesn’t count as a manufacturing process.

Qualifying Research Expenditures for Manufacturing Firms

Only select expenditures are classified as qualified research expenses for the R&D tax credit. In particular, the following count:

- Wages paid to employees directly involved in Qualifying Research Activities, including bonuses and taxable commissions. The company must present supporting documents, including timesheets, project descriptions, and employee job descriptions.

- Supplies used for research and development. All tangible material bought for R&D activities counts as qualified research expenses. The company must present documentation like invoices, receipts, and so on.

- Contract research expenses are when a business performs qualified research on behalf of the taxpayer. In this case, 65% of the amount paid to the non-employee can be considered a qualified expense.

How to Claim Manufacturing R&D Tax Credits

Companies must file IRS Form 6765, Credit for Increasing Research Activities, for this tax benefit. This process includes determining qualifying research activities and providing documentation proving these costs meet the Internal Revenue Code Section 41 requirements. Companies may use business records, financial records, oral testimonies, and technical documents.

Before you complete this form, you should familiarize yourself with the instructions mandated by the IRS. The PDF version of this form can be downloaded from the IRS website.

In general, the IRS Form 6765 has four sections:

- Section A is utilized to claim the regular credit and has 11 lines of required information.

- Section B applies to the Alternative Simplified Credit or ASC.

- Section C identifies additional forms and schedules that require reporting based on one’s business structure.

- Section D only applies to qualified small businesses or QSBs making a payroll tax election.

The IRS recommends that companies calculate their credit using regular and simplified methods and then fill out sections (A or B), resulting in the most significant tax benefit. Getting assistance from companies specializing in tax credit services would be ideal to avoid possible mistakes.

3 Benefits for Claiming Manufacturing R&D Tax Credits

The R&D tax credit can help qualified companies enjoy several benefits, including the following:

- Reduced tax liability: This tax benefit can help a manufacturing firm lower its overall tax bill. This tax credit can also lower other tax-related expenses, like payroll taxes.

- Increased cash flow: his tax benefit permits manufacturers to allocate more money for R&D expenses. The money they receive can offset current or future tax liabilities, freeing up cash for other business needs.

- Encouragement of innovation: Companies that benefit from this tax claim are more motivated to engage in activities that foster innovation and count as future credits.

How to Calculate Manufacturing R&D Credits

There are two ways to calculate manufacturing R&D credits:

Regular Research Credit

For the traditional method of calculating this amount, you need to calculate the credit as 20% of the excess of current year Qualified Research Expenses (QRE) over a base amount. Most startups use this method, which yields the highest credit for most technology companies.

Alternative Simplified Credit

Companies using the alternative simplified credit (ASC) must provide a 14% credit for QRE exceeding 50% of their average QRE for the preceding tax years.

Apply for Manufacturing R&D Tax Credits Today

Eligible manufacturing companies should take advantage of tax credits, like the R&D tax credit—fortunately, plenty of manufacturing activities account for this tax benefit. However, companies should seek professional assistance to avoid miscalculating or missing required documentation.

FAQs

What documentation is necessary for the R&D tax credit?

Companies must present documentation such as receipts, payroll registers, and invoices that support the expenses they claim.

How much can a company save with Manufacturing R&D tax credits?

The Manufacturing Tax Credits depend on the company’s size and activities. Companies can save up to $5 million through this tax benefit.

What is the 80% rule for R&D credit?

Businesses can claim 100% of W-2 wages paid to employees, spending at least 80% of their time on qualified R&D activities. This allows businesses to estimate the qualified R&D amount to be 80% or more for salaried employees and use the complete 100%.

What are the examples of R&D in manufacturing?

Improving product quality, processes, and systems is considered R&D in manufacturing.

What is the 25% limitation for R&D credit?

The “25/25 limitation” restricts C-corporations with over $25,000 in regular tax liability from offsetting more than 75% of their tax liability using the R&D tax credit.