How To File Under the Corporate Transparency Act: A Guide

The Corporate Transparency Act is a transparency law that is meant to require beneficial owners of companies to report their personal information to the Financial Crimes Enforcement Network, also known as FinCEN, to help law enforcement identify and track down individuals associated with financial crimes such as tax fraud, terrorist financing, and money laundering over time.

Filing your first beneficial ownership information report can be frustrating for new businesses, but filing doesn’t have to be complicated! Here, we will take you step by step through filing your first beneficial ownership information report, what that means for your business, and how to remain compliant with the Corporate Transparency Act in the future.

How to File Under the Corporate Transparency Act?

Beneficial ownership information reporting with the CTA can be complicated, but following these steps will ensure that you have the information you need to file correctly the first time:

Step 1: Determining If Your Business is Required To File

If you’re unsure whether or not your business has to file a beneficial ownership information report, there are three things you should consider. While not all businesses in the United States will need to file under the Corporate Transparency Act, failing to do so can have civil or criminal consequences for your business.

The first thing you should consider is the type of entity under which your business is filed. Reporting companies almost solely include for-profit businesses, such as corporations and limited liability companies, or LLCs. Businesses such as publicly traded companies or financial institutions are often exempt from this rule because they have to file under separate transparency acts.

A general rule of thumb is that corporations, LLCs, and other business entities that are formed with the secretary of state or tribal secretary of state office are going to be subject to beneficial ownership information reporting. Exemptions include:

- Large operating companies

- Inactive entities established on or before January 1st of 2020, not currently in business

- Non-profit

- Other exemptions from Corporate Transparency Act reporting standards

- Small businesses that are members of the National Small Business Association, or the NSBA, as of March 1st of 2024.

Your company’s size and age can also impact how and when you need to file. Reporting companies are generally smaller, having 20 or fewer full-time employees. Older companies also have a different filing deadline, with companies formed before January 1st, 2024, not needing to report until January 1st, 2025. Businesses formed after January 1st, 2024, have 90 days to file beneficial ownership reports with the Financial Crimes Enforcement Network.

Step 2: Identifying Beneficial Owners and Company Applicants

Finding out your beneficial owners and company applicants before filing can help you keep your information more organized and assist in verifying any information before submitting it to the Financial Crimes Enforcement Networks database.

A beneficial owner, according to the Corporate Transparency Act, is an individual who can exercise substantial control over a company. This can include the hiring and firing of presidents and vice presidents, holding an executive position, and more. Generally, the rule of thumb is that if you meet these three criteria, you are considered a beneficial owner:

- You own or control at least 25% of the company’s voting equity or have the right to determine a quarter of the votes on important matters of company policy.

- Have the right to appoint or remove most of the company’s directors or managers, allowing you to exercise substantial control over leadership.

- Has the right to control major financial decisions for the company.

Have the designated company applicant contact the beneficial owner to receive the updated required information and to tell them what information you will need to fill out the report. If they would prefer, they may apply for a FinCEN identifier to report the information directly without using a company applicant.

Step 3: Gathering Required Information for the Beneficial Ownership Information Report (BOIR)

The information you report to the Financial Crime Enforcement Network should be current and correct, but which information do you need to report? Both beneficial owners and company applicants need to report their personal information to the FinCENs database. Here are the specific requirements for both:

- Beneficial owners are required to report their full legal name, date of birth, current residential addresses, an identifying number from one of their government-issued IDs, as well as a digital image of the document that they got the number from.

- Company applicants are required to report their full legal name, date of birth, current residential address OR business address, an identifying number from one of their government-issued IDs, and a digital image of the document containing their identifying number. The key distinction is the addresses, as company applicants may use their business or residential addresses.

After gathering the required information, double-check to ensure it is correct. If any of the information changes, you have 30 calendar days to update your information to remain compliant with the Financial Crimes Enforcement Network. Keep your company applicants updated on any changes to beneficial owners’ information to make the process easier.

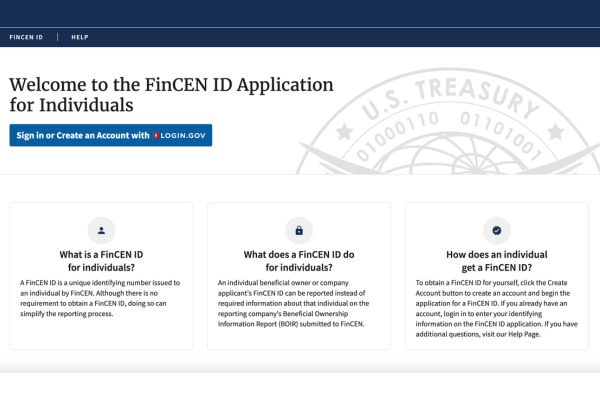

Step 4: Obtaining a FinCEN Identifier (Optional)

Using a FinCEN Identifier, while entirely option, may streamline the filing process. This is a unique identification number that is given by FinCEN as a substitute for certain information about beneficial owners on your initial report. Some of the benefits of using these identifiers can be increased privacy, streamlined reporting, and reduced risk for errors.

Applying for a FinCEN Identifier is straightforward. You can apply electronically through FinCEN’s BOI filing system, only requiring basic information. Once this application is submitted, your FinCEN Identifier is typically issued immediately. This makes the process much faster when completing the application in the future.

Step 5: Filing the Beneficial Ownership Information Report

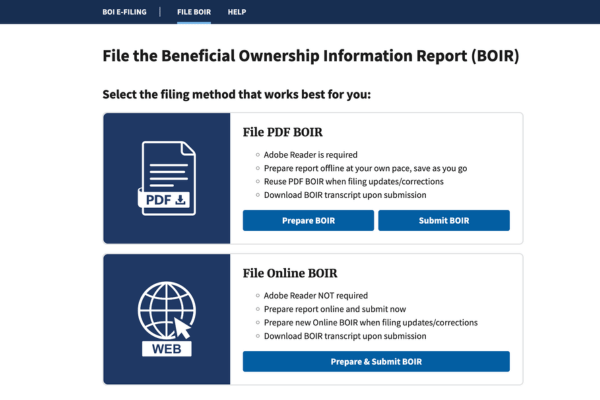

As of January 1st, 2024, the Financial Crimes Enforcement Network began accepting beneficial ownership information reports, making it important that you begin filling out your initial filing as soon as possible. There are two ways that you can submit your report:

First, you can complete and upload a PDF form that the Financial Crimes Enforcement Network provides on its website. After downloading this form, fill it out electronically using software like Adobe Acrobat or a similar PDF editing program. Once filled, you can upload the completed PDF through FinCEN’s BOI filing system.

You also have the option to use FinCEN’s Online Platform for a more streamlined reporting process. After visiting the BOI filing platform, you follow the prompts provided to you by the website. These will instruct you to enter information about your company, beneficial owners, and company applicants.

After filling out these prompts, you will be given instructions to download a digital image of each beneficial owner and company applicant’s identification document as required by the CTA. Regardless of the method of filing you choose, ensure you have all of the required information available before starting the process.

Maintaining Compliance with the Corporate Transparency Act

Filing the initial BOI report is the first step, but you should keep your information current to stay compliant with the Corporate Transparency Act. Creating a system to monitor changes that may impact your beneficial ownership information, such as:

- Changes in beneficial ownership, such as buying or selling shares.

- Updates to information such as address changes, name changes, and updated driver’s licenses.

- Alterations in company structure or control rights that may impact beneficial ownership.

Make sure to assign individuals to oversee BOI compliance, particularly someone with experience with CTA requirements who can handle tasks such as updating beneficial ownership information and keeping information organized for potential changes. Have them review beneficial ownership quarterly or annually to ensure that your BOI report remains accurate.

Penalties and Consequences of Non-Compliance

Because the Corporate Transparency Act is supposed to assist in law enforcement of financial crimes, there are civil and criminal penalties for companies that refuse to comply with their standards.

The Corporate Transparency Act authorizes the Financial Crimes Enforcement Network to impose civil penalties for non-compliance, which can reach up to $500 per day with a maximum of $10,000. These can be implemented if there is a failure to file an initial beneficial ownership report or there are deadlines missed on changes to beneficial owner information.

Inaccurate information can also trigger civil penalties, so corrections should be submitted as soon as possible.

Criminal penalties for purposeful violations can lead to a potential 2 years of jail time and significant fines. The Corporate Transparency Act defines “willful” as acting knowingly and voluntarily, with a specific intent to violate the law and avoid giving important information to the Financial Crimes Enforcement Network.

The best way to avoid these penalties is by ensuring accurate and timely reporting of beneficial ownership information, studying the Corporate Transparency Act, and taking active steps toward compliance.

Fulfill Corporate Transparency Act Compliances with TaxCredits

At TaxCredits, we understand the importance of staying compliant with important transparency laws in this complicated legal landscape. Our team of experienced accountants has a deep understanding of the Corporate Transparency Act and can help keep you compliant.

The Corporate Transparency Act is an important part of law enforcement efforts to monitor financial crime. With TaxCredits, you gain a trusted advisor to ensure your business remains compliant and minimizes the risk of penalties and disruptions.

FAQs

Where to file the Corporate Transparency Act?

Beneficial Ownership Information Reports should be submitted electronically to the Financial Crimes Enforcement Network. It should never be submitted through email, physical copies of documents, or through outside solicitation. These are scams and should be reported to the correct authorities.

Where do I file a BOI Report?

You can file your BOI report through the Financial Crimes Enforcement Networks website, either in PDF form or through their official system for a more streamlined process.

How much does it cost to file a report under the Corporate Transparency Act?

It is completely free to file a report, including your initial BOI, any changes that need to be made, and any direct communication that you need. However, there are civil and criminal charges that can cost money if you are found to violate the Corporate Transparency Act.

Do I have to file under CTA?

If you do not fall under one of the exceptions that the Corporate Transparency Act outlines, then you do have to file a BOI report. The deadlines may change based on when your company was created. Consult a lawyer if you’re unsure of whether you’re required to file.